Now Reading: The Controversial Rise and Fall of Bitcoin Investment

-

01

The Controversial Rise and Fall of Bitcoin Investment

The Controversial Rise and Fall of Bitcoin Investment

Bitcoin investment’s rollercoaster rise and fall has sparked controversy. The digital currency experienced a surge in value, hitting a high of nearly $20,000 in late 2017, only to crash in the following months, losing up to 80% of its value.

Despite the volatility, some investors still view virtual currency as a viable investment opportunity, while others caution against investing due to its unpredictable nature and lack of regulation. Alongside the fluctuations, bitcoin’s reputation has been marred by illegal and criminal activities associated with its use.

This article will examine bitcoin’s history, its rise and fall as an investment option and explore the challenges and opportunities associated with investing in cryptocurrencies.

Credit: time.com

The Early Days of Bitcoin

Satoshi nakamoto‘s whitepaper introduced Bitcoin in 2008 as a decentralized digital currency. The idea was met with skepticism, making its adoption slow. In 2010, the first Bitcoin transaction was made exchanging two pizzas for 10,000 btc, now worth millions of dollars.

Early supporters like roger ver, erik voorhees, and wences casares invested in Bitcoin, making a fortune. However, bitcoin’s reputation became tarnished with fraudulent activities on different exchanges like mt. Gox. Price fluctuations in the market led to heightened speculation, causing it to have an uncertain future.

Bitcoin’s rise and fall have been controversial, leaving investors to ponder what the future holds.

Bitcoin Investment’s Explosive Growth

Bitcoin investment’s explosive growth can be attributed to several factors. One of the main drivers has been the rise of cryptocurrency exchanges, which made it easier for people to acquire and trade bitcoin. In addition, the attention the cryptocurrency received from mainstream media helped generate interest among the general public.

Early investor success stories served as an inspiration to many, fueling the frenzy around Bitcoin investment. The surging market interest and valuation of Bitcoin resulted in significant profits for many investors. However, this success brought about controversies as it significantly impacted global economies and traditional financial institutions.

The rise and fall of Bitcoin investment continues to be a topic of debate among investors and experts.

The Onset of Controversy

Recent years have seen the rise and fall of bitcoin investment undergo intense scrutiny and controversy. Increased regulation, governmental action, and several security issues and hacking incidents have tarnished the once highly sought-after cryptocurrency’s reputation. Notable scams involving bitcoin investment further fueled the debate, while the rise of altcoins and the competition they bring has diminished bitcoin’s dominance.

Increased scrutiny and debate among the investment community continue to question the long-term viability of bitcoin. As the cryptocurrency market evolves, uncertainty remains, making bitcoin investment a risky, yet potentially rewarding, venture.

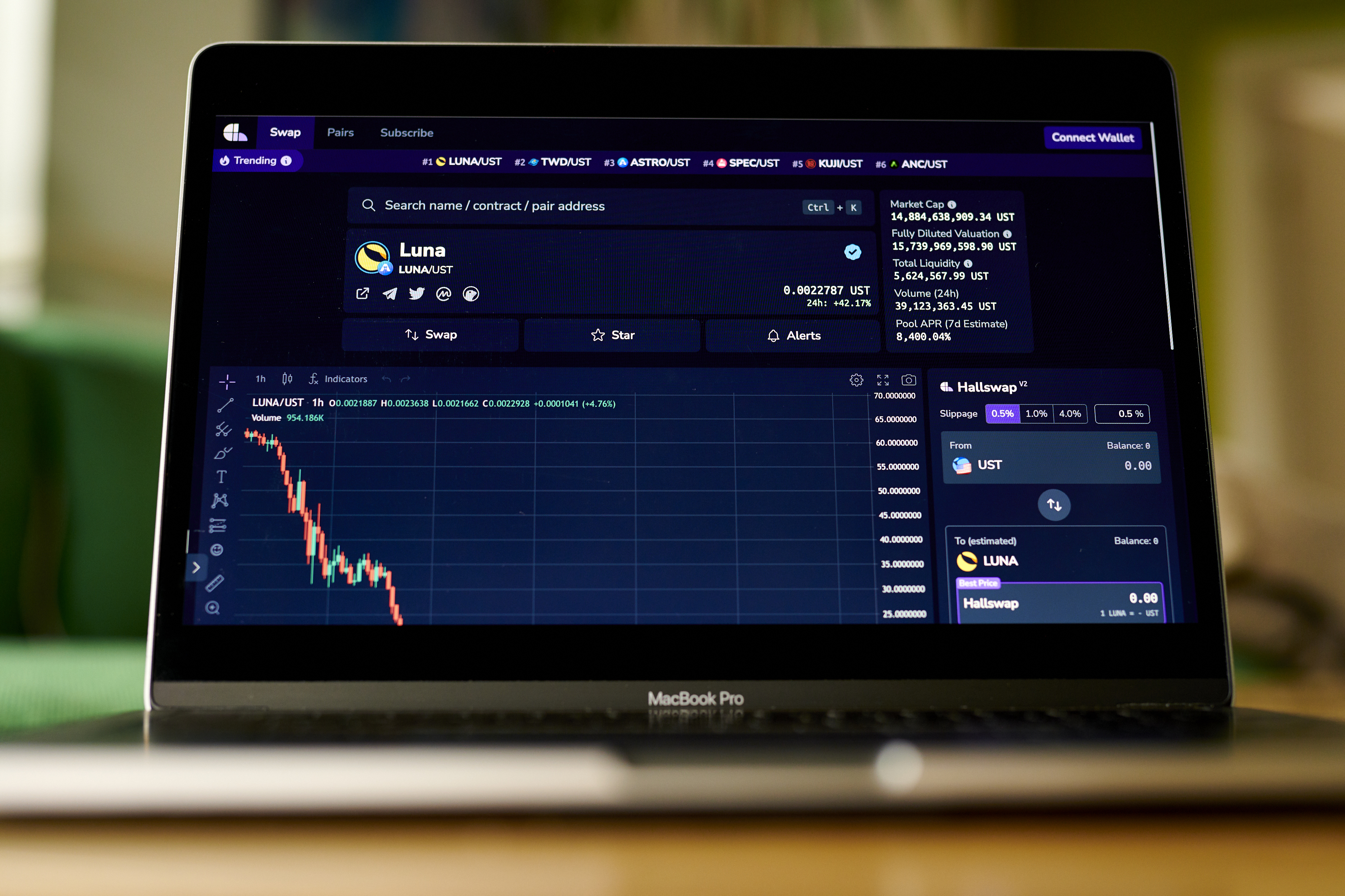

The Fall of Bitcoin Investment

The 2017 bitcoin bubble saw a meteoric rise in value, leading to an investor buying frenzy. However, what goes up must come down, and panic selling quickly followed. The aftermath of the fall caused a negative impact on the overall crypto market, with many investors selling off their entire portfolio.

From the fall of bitcoin investment, we have learnt that hype and speculation are not sustainable and careful analysis is necessary. The future of bitcoin and crypto investment remains uncertain, but the fall of bitcoin has taught us important lessons that could help create a more stable investment environment.

Frequently Asked Questions on The Controversial Rise And Fall Of Bitcoin Investment

What Is Bitcoin Investment?

Bitcoin investment is the act of buying and holding a bitcoin currency. Bitcoin is a decentralized digital currency that can be bought, sold, and traded. It operates on a blockchain technology that makes it difficult to counterfeit.

Why Did Bitcoin Investment Rise To Popularity?

Bitcoin investment rose to popularity as it provided investors a chance of making huge gains in value. Also, it provided an alternative to the traditional investment methods that were plagued by strict regulations and high transaction fees. Its decentralization made it more appealing to investors looking for security and privacy.

What Led To Bitcoin Investment’s Fall From Grace?

Bitcoin’s fall from grace is attributed to the numerous scams and frauds associated with it. Also, the lack of proper regulation made it susceptible to market manipulation, making it a risky investment to undertake. The instability of the cryptocurrency market and the susceptibility of bitcoin to cyber-attacks also resulted in its downfall.

Is Bitcoin Investment Still Worth It In 2021?

Bitcoin investment is still a risky investment, but the recent increase in value has raised the optimism of investors. The adoption of bitcoin by prominent companies and personalities has also contributed to its rise in value. Its decentralized nature, limited supply, and growing utility make it a valuable investment to consider.

Can I Invest In Bitcoin For The Long Term?

Investing in bitcoin for the long term involves holding the cryptocurrency for extended periods, even years. As with any investment, it involves risk, and investors must do their due diligence before investing. Investing in bitcoin for the long-term requires a deep understanding of the cryptocurrency market, its volatility, and a grasp of the underlying technology powering it.

Conclusion

The rise and fall of bitcoin investment has been nothing short of controversial. While some have reaped massive profits, others have lost their life savings, causing regulators and sceptics to call for stricter controls. The volatile nature of the market, coupled with the lack of government backing, has left many investors wary and uncertain about the future of this cryptocurrency.

Despite this, the technology behind bitcoin and blockchain remains a game-changer that has the potential to revolutionize the world of finance. As more institutions and companies begin to embrace it, we can expect to see more stability in the market.

It is up to investors to carefully navigate this evolving landscape and make informed decisions. Ultimately, only time will tell if bitcoin investment will prove to be a wise or regrettable decision. Regardless, this digital currency is here to stay and its impact will continue to be felt in the years to come.